Fintech Foundations: Credit Card Payment Processors Driving Financial Innovation

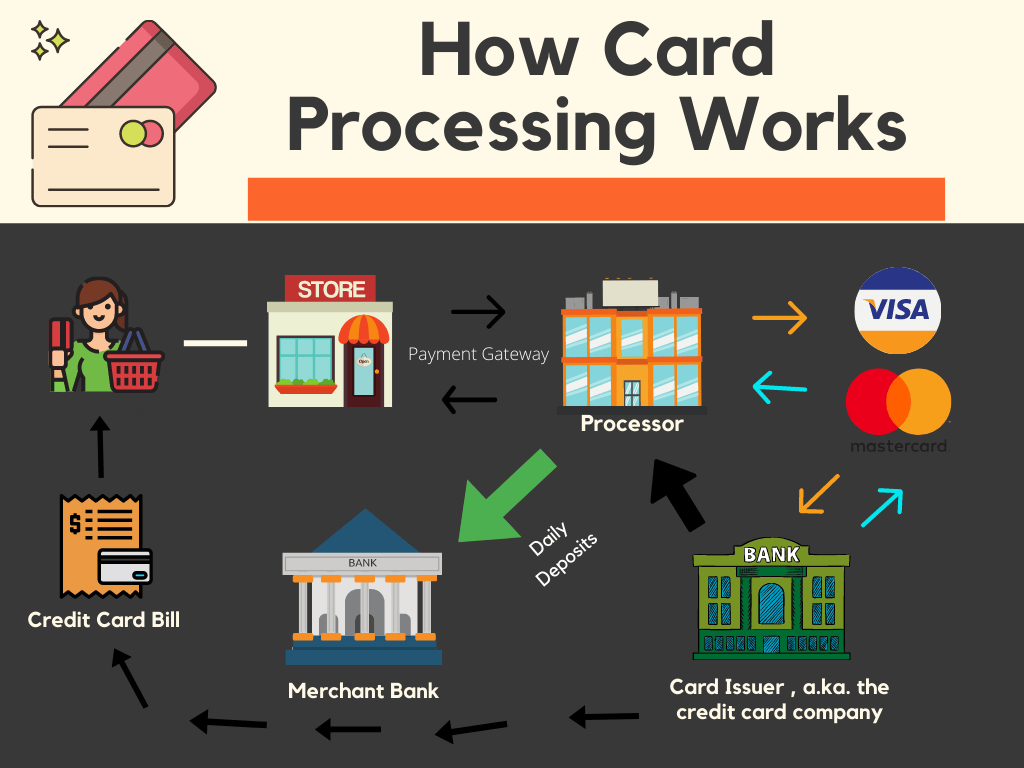

A bank card payment processor plays a pivotal position in the present day economic landscape, serving because the linchpin that facilitates digital transactions between merchants and customers. These processors become intermediaries, joining organizations with the banking system and allowing the smooth transfer of funds. The fact of these purpose is based on translating the data from a bank card exchange in to a language clear by economic institutions, ensuring that payments are approved, processed, and resolved efficiently.

One of many primary operates of a credit card cost processor is to boost the efficiency of transactions. Whenever a customer swipes, inserts, or sinks their credit card, the payment model rapidly assesses the exchange facts, communicates with the applicable economic institutions, and validates whether the obtain can proceed. This method does occur in a matter of moments, focusing the speed and real-time nature of credit card payment processing.

Security is just a paramount matter in the world of economic transactions, and bank card payment processors are at the lead of applying actions to protect sensitive information. Advanced encryption technologies and submission with industry requirements ensure that customer knowledge remains protected through the payment process. These safety measures not only safeguard consumers but additionally impress rely upon companies adopting electronic cost methods.

The charge card payment handling ecosystem is frequently changing, with processors establishing to technical advancements and adjusting client preferences. Cellular payments, contactless transactions, and the integration of digital wallets symbolize the lead of invention in this domain. Bank card cost processors perform a crucial position in enabling firms to remain forward of the tendencies, giving the infrastructure required to support varied cost methods.

Beyond the traditional brick-and-mortar retail room, credit card payment processors are important in powering the large landscape of e-commerce. With the increase of online buying, processors facilitate transactions in a virtual setting, handling the complexities of card-not-present scenarios. The ability to seamlessly steer the difficulties of electronic commerce underscores the flexibility and usefulness of bank card cost processors.

Worldwide commerce relies seriously on credit card cost processors to facilitate transactions across borders. These processors handle currency conversions, address international conformity needs, and ensure that corporations can operate on a worldwide scale. The interconnectedness of financial programs, supported by credit card cost processors, has developed commerce into a really borderless endeavor.

Bank card payment processors lead considerably to the growth and sustainability of little businesses. By offering electronic payment alternatives, these processors permit smaller enterprises to increase their client foundation and compete on an even enjoying field with larger counterparts. The supply and affordability of charge card payment control services are becoming important enablers for entrepreneurial ventures.

The landscape of charge card payment control also requires concerns of scam avoidance and regulatory compliance. Payment processors implement strong methods to discover and prevent fraudulent activities, defending equally businesses and consumers. Additionally, remaining abreast of ever-evolving regulatory needs assures that transactions adhere to legal requirements, how to become a credit card processor the standing and strength of the payment running industry.

In summary, bank card payment processors type the backbone of contemporary financial transactions, facilitating the smooth movement of resources between firms and consumers. Their multifaceted position encompasses speed, protection, versatility to technological changes, and help for international commerce. As engineering continues to advance and customer preferences evolve, charge card payment processors may remain key to the powerful landscape of electronic transactions, shaping the future of commerce worldwide.